Section A – This ONE question is compulsory and MUST be attempted

Introduction

A business architecture training market has developed in the last two decades in the continent of Eastaria to train business analysts in this important subject area. QTSBA and Aspire to Knowledge (A2K) are both specialist providers of business architecture training and compete in this market. QTSBA is part of the Quality Training Synergies (QTS) Group and it is the market leader in this niche market. QTS Group is currently considering the possible acquisition of A2K with the intention to merge it with QTSBA after acquisition.

QTS Group

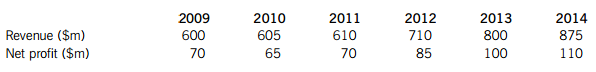

QTS Group is a significant, publicly quoted, training and education provider in Eastaria. QTS Group controls a number of independent trading companies which serve niche training markets across Eastaria. Every day, companies across QTS Group deliver more than a thousand courses. To help establish a common delegate experience, QTS Group insists on a standard, centrally defined approach to training in an attempt to ensure that courses are delivered in a consistent way. Revenue and net profit for the group is shown in Table One.

Table One: Revenue and net profit for QTS Group (2009–2014)

Much of the recent growth of QTS Group has been achieved through acquiring niche information technology training companies. QTS Group has a good reputation for managing such companies post acquisition. In the three companies acquired in the last two years, profitability (as measured by the ROCE and the net profit margin) has increased in all three companies post acquisition. QTS Group believes that it has core competencies in acquisition and strategic change implementation, and that these core competencies are demonstrated by the improved performance of these recently acquired companies.

However, shareholders of QTS Group remain concerned about the group’s current high level of retained earnings. They perceive that recent acquisitions by QTS Group have delivered value to shareholders because there has been an increase in both the dividend payout ratio and in earnings per share. A vociferous minority of shareholders are lobbying the board to continue this policy of acquisitions, using the retained profit of the group to drive further growth, particularly in terms of revenue and profit. In acknowledgment of this, the QTS Group board has announced an ‘acquisition fund’ of $30m to further acquire companies and finance post-acquisition change. A2K is the first of a number of companies which QTS Group is looking to evaluate for possible acquisition.

Business strategy is decided at group level and then implemented by the individual companies. There is a formal reporting system from these companies to the group.

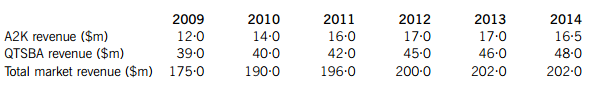

Although growth in the business architecture training market has slowed, QTS Group is committed to remaining in this market. It forecasts future world-wide growth in this market and it intends to look for opportunities outside of Eastaria in the future. Revenues and other relevant information from the business architecture training market in Eastaria are shown in Table Two.

Other information:

(1) QTSBA is the market leader in this market sector

(2) The second largest training provider, CompTrain, recorded revenue of $31·31m in 2014

(3) Independent research shows that companies operating in this market have an average return on capital employed (ROCE) of 25% and an average net profit margin of 10%

Table Two: Sales revenue and other relevant information in the business architecture training market in Eastaria (2009–2014)

QTSBA

In 2011, QTSBA appointed an experienced senior management team to improve the company’s performance in the business architecture training market. To attract capable managers, QTSBA offered remuneration packages which were linked directly to achieving sales revenue performance targets.

It is acknowledged within QTS Group that QTSBA has strong sales and marketing competencies and it has recently won two major government business architecture training contracts. However, it is having difficulties finding experienced trainers and it needs to quickly recruit these trainers as a number of training programmes it has successfully bid for are about to commence. It is also acknowledged in QTSBA that the sales and marketing department of QTSBA has spare capacity, ‘we could sell more if we had more to sell’ is a common complaint of the sales and marketing team.

QTSBA has attempted to produce e-learning products in the past. However, the project to develop these products was unsuccessful. A team of software developers was recruited and an e-learning development platform. selected. However, the company found it difficult to control the programmers’ work. As one senior manager commented, ‘we are training course providers, not a software house.’ It transpired that the purchased e-learning platform. was slow and inflexible and the learning solutions produced by the team were not what customers wanted. After two years, the project was abandoned, the programming team disbanded and the investment written off.

Aspire to Knowledge (A2K)

A2K was established in 1986 by Lee Wan and Kim Cross. In 2002, up and coming business architecture guru Kath Goff joined the company. These three people are still the primary shareholders of the company. Lee owns 25% of the shares, Kim owns 35% of the shares and Kath owns 35% of the shares. The current marketing director and sales director of the company each own 2·5% of the shares. Lee and Kim are now retired and the board consists of Kath Goff (as chief executive officer – CEO), the marketing director and the sales director.

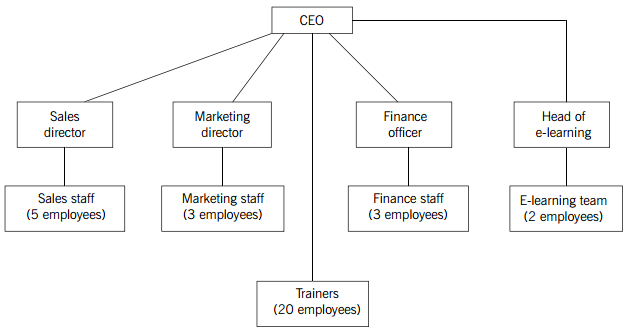

A2K’s organisational structure is shown in Figure One. This chart only shows full-time business architecture trainers. The company also employs a number of sub-contracted trainers who are self-employed and who undertake training for A2K on an ad hoc basis.

Figure One: A2K’s organisational structure – 2014

Kath Goff is an intelligent, charismatic individual with an in-depth knowledge of the business architecture training market. Although strategy is nominally the responsibility of the board, in practice the strategy reflects her vision. Indeed, she makes most of the significant decisions in the company. The marketing director has attempted to question her judgement in the past and has put forward alternative strategies. However, these have been quickly dismissed by Kath, claiming that he ‘just doesn’t understand the business architecture market’. Kath has also issued a number of public rebukes to other members of staff and employees who have found her direct approach unacceptable have quickly resigned and moved to other companies.

The early success of A2K was largely based on Lee and Kim’s distinctive and innovative approach to training. The company soon became known as a company which did things slightly differently, with courses which were both challenging and humorous. To try and maintain this spirit, Kath still arranges regular company events, trying to recreate what she now considers to be the golden age of business architecture training. Indeed, Lee and Kim are always invited back to the annual ‘celebration event’ where Kath, Lee and Kim sit together all evening recounting tales from the old days. The current full-time trainers find such events tiresome and demotivating. They feel that customers now expect more professional, standard courses and that delegates’ expectations have changed and are now more exacting. The full-time trainers employed by A2K are continually rated as ‘excellent’ by customers. However, these trainers are frustrated by their lack of input into company strategy and training decisions, as well as by the continued presence of Lee and Kim at company events. They find it hard to reconcile exciting tales of the past with the increasingly aging, fragile men sitting next to the CEO.

A2K has a small, but experienced e-learning software development team. A number of e-learning products have been produced over the last few years and are available for immediate purchase on the company’s website. Sales are relatively strong and the unit profit margin, like all e-learning products, is significant as there is virtually no variable cost in delivering an e-learning course to a customer. However, the e-learning team is demotivated. It is concerned at the company’s apparent lack of commitment to e-learning (as against conventional face-to-face training) and the young head of e-learning, Ash Tag, is particularly angry at the company’s reluctance to give him (and hence e-learning) a place on the board.

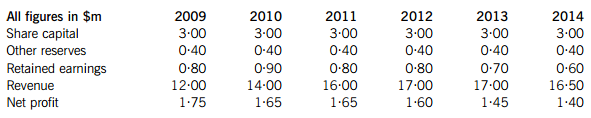

A2K was particularly successful in 2010, 2011 and 2012 when it successfully competed against QTSBA for a number of major business architecture training contracts (see Table Three).

Although A2K has traded relatively successfully since its inception, the CEO has been increasingly concerned that costs are not properly under control. She has evidence that costs per training day have risen whilst revenue per training day has fallen, due to increased competition in the business architecture training market. This has led the CEO to become increasingly involved in the day-to-day operations of the company, particularly in monitoring the financial situation, because she has little confidence in her finance staff.

Table Three: A2K – Figures extracted from financial statements: 2009 to 2014

Preparing for acquisition of A2K

The board of QTS Group is now preparing to approach A2K with an acquisition offer. Representatives of QTS Group have already met informally and independently with Lee and Kim (who both indicated their willingness to sell at the right price) and with the board of A2K (the CEO, sales director and marketing director). The latter meeting was quite strained, but the impression was formed that the acquisition would be considered favourably if the CEO, sales director and marketing director were employed, post-acquisition, in an autonomous company within QTS Group. This was put on the agenda, but no promises were made. Privately, the QTS Group board are sceptical whether these three senior managers could work in a more formal organisation or indeed, whether they are needed at all. They have no plans to make A2K an autonomous company within the group and indeed their intention is to merge the company with QTSBA.

Required:

The managing director of QTS Group has approached you as a business analyst and asked you to produce a briefing paper which addresses a number of key issues:

(a) Identify and discuss the benefits and advantages to QTS Group and QTSBA of acquiring A2K. The managing director stresses that he just wants the benefits and advantages considered. He wants you to focus on the positive factors which would emerge from this acquisition. (19 marks)

(b) QTS Group policy mandates that a strategic change evaluation should be undertaken before any possible acquisition is made. This looks at strategic change in terms of time, preservation, diversity, capability and readiness. These are five selected elements from the Balogun and Hope-Hailey model which considers the contextual features of strategic change.

Evaluate the strategic change required at A2K if the company is acquired and subsequently integrated with QTSBA. This evaluation should use the contextual features of time, preservation, diversity, capability and readiness. (15 marks)

(c) Finally, the managing director is interested in the organisational culture of A2K. He is concerned that it ‘is just such a different company to us’. So, the final part of your briefing paper is to explain the principles of organisational culture and the concept and application of the ‘cultural web’ and Mintzberg’s organisational configurations.

Explain the concepts of organisational culture, the cultural web and organisational configurations in the context of the possible acquisition of A2K and its post-acquisition integration with QTSBA. (12 marks)

Professional marks are available in question 1 for the tone, clarity, vocabulary and approach of your answer. (4 marks)